stock option tax calculator canada

The options were granted within. Youll pay capital gains tax in Canada on the difference when you buy a share and then sell it for a higher price.

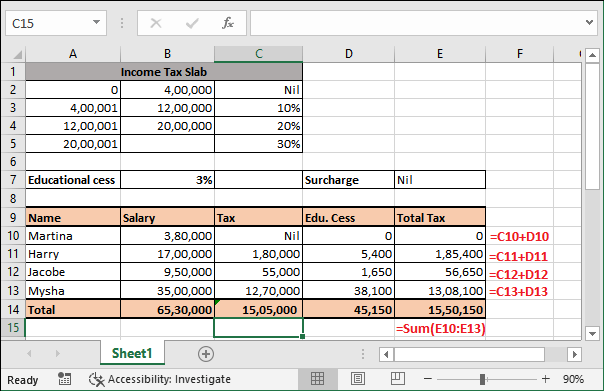

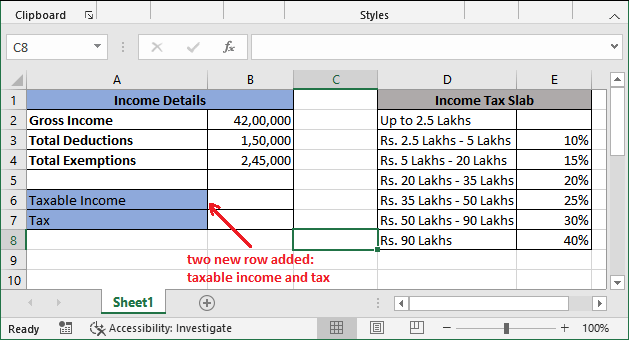

What Is The Formula To Calculate Income Tax

By changing any value in the following form.

. On this page is an Incentive Stock Options or ISO calculator. Cpa canada believes it is in the public interest to limit stock option benefits in some cases. The key points are as follows.

The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. It can also show your worst-case AMT owed upfront total tax and its breakdown and the allocation of income depending on your exercise. This plan allows the employee to purchase shares of the employers company or of a non-arms length company at a predetermined price.

This capital gains tax reduction doesnt apply for day traders who pay 100 tax on income from capital gains. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax. Annual Stock Option Grants Inputs.

You have held the shares for at least two years after you have purchased them. A stock option plan to acquire shares of. Abbreviated Model_Option Exercise_v1 -.

50 of the value of any capital gains are taxable. Preferential tax treatment on stock options granted after June 30 2021 will be capped at 200000 per year of vesting. If you decide to exercise your option and buy the securities at less than the fair market value FMV you will have a taxable benefit received through employment.

Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit. Abbreviated Model_Option Exercise_v1 - Pagos. The Canada Annual Tax Calcu.

You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and gross income. Use the simple annual Capital Gains Tax Calculator or complete a comprehensive income. This entry is required.

The stock price is 50. This entry is required. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

Redirecting to toolsstock-option-tax-calculator 308. The securities under the option agreement may be shares of a corporation or units of a mutual fund trust. If you meet one of these two conditions you can claim a tax deduction equal to ½ of the taxable benefit or 350 in this example 50 x 7.

Use this calculator to determine the value of your stock options for the next one to twenty-five years. The Stock Option Plan was approved by the stockholders of the grantor within 12 months before or after the date of adoption of the Plan. Locate current stock prices by entering the ticker symbol.

Please enter your option information below to see your potential savings. Enter an amount between 0 and 20. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net proceeds.

The capital gains tax rate in Ontario for the highest income bracket is 2676. I was reading on the tax advantages and disadvantages of futures contracts and their options. Enter an amount between 1 and 1000.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Select Province and enter your Capital Gains. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

Enter an amount between 0 and 10000. This entry is required. For more information refer to Security options deduction for the disposition of shares of a Canadian-controlled private corporation Paragraph 110 1 d1.

The Stock Option Plan specifies the total number of shares in the option pool. This calculator illustrates the tax benefits of exercising your stock options before IPO. Canada Tax Calculator 2021 2021 Salary Calculator How much are your.

Even after a few years of moderate growth stock options can produce a handsome return. Because you have essentially earned an extra 5000 that amount is taxable and must be claimed on your income tax return. Enter an amount between 3 and 25.

This entry is required. If you buy a share for 1000 and sell it for 2000 you. Important Note on Calculator.

Remember for employees of CCPCs the taxable benefit is postponed until the shares are sold. As many know futures are taxed 6040 long term capital gains low tax rate vs short term higher rate but your losses can only be deducted similarly so on losing positions the 6040 treatment is a disadvantage. An option is an opportunity to buy securities at a certain price.

Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. When you exercise your employee stock options a taxable benefit will be calculated. The taxable benefit is the difference between the fair market value FMV of the shares or units when the employee acquired them and the amount paid or to be paid for them including.

The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Rental Property Management Income Property

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Couples Budget Spreadsheet With Monthly Shared Personal Etsy Canada Budget Spreadsheet Budgeting Monthly Budget Spreadsheet

Income Tax Calculating Formula In Excel Javatpoint

Free Home Equity Investment Calculator Investing Real Estate Investing Flipping Real Estate Investing Rental Property

Inflation Derivatives Definition Option Strategies Stock Market Investing

Income Tax Calculator Fy 2022 23 Calculate New And Old Regime Tax

Tax Free Savings Account Tfsa My Road To Wealth And Freedom Tax Free Savings Savings Account Small Business Tax Deductions

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculating Formula In Excel Javatpoint

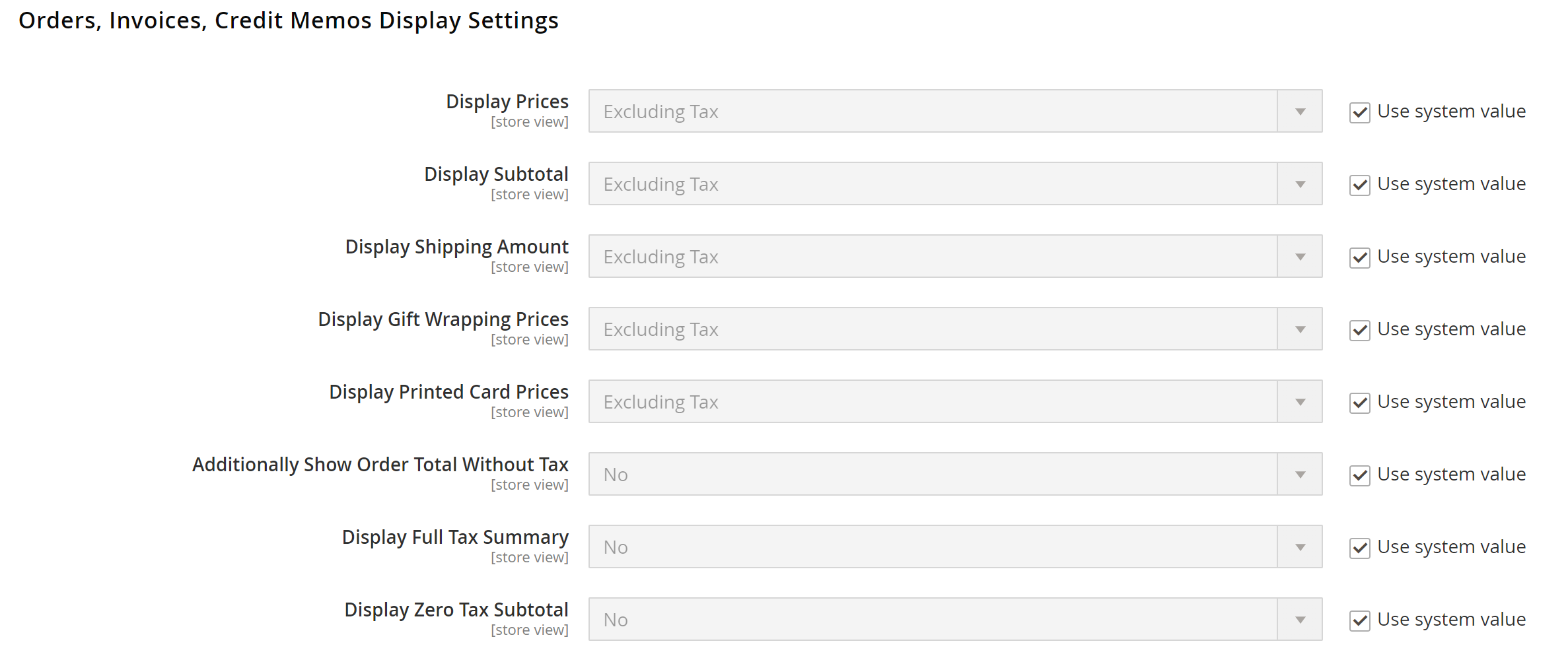

General Tax Settings Adobe Commerce 2 4 User Guide

How Fees Can Lower Your Income Tax Koinly

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Income Tax Calculator Fy 2022 23 Calculate New And Old Regime Tax

Additional Payment Calculator Mortgage Payment Calculator Instantly Calculat Monthly Mort Mortgage Payment Calculator Mortgage Payment Refinancing Mortgage